new mexico gross receipts tax table 2021

A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

Gross Receipts Location Code And Tax Rate Map Governments

The retail trade industry Chart2.

. Albuquerque 02-100 78750 Texico 05-302 75625 Edgewood Bernalillo 02-334 78750 Remainder of County 05-005 61250. New Mexico has a state income tax that ranges between 17 and 49 which is administered by the New Mexico Taxation and Revenue Department. 1700 cents per gallon of regular gasoline 2100 cents per gallon of diesel.

Gross Receipts by Geographic Area and NAICS code. There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257. Information on 2021 Personal Income Tax Rebates is available here.

CRS Redesign As of July 6 2021 the Department. Gross Receipts by Geographic Area and NAICS Code. Hearing scheduled April 29 on new Gross Receipts Tax regulations.

May 19The state since March has been allowing restaurants bars and brewpubs to keep the gross receipts tax they collect but so far only 552 have taken the New Mexico Taxation Revenue Department up on the offer. FY22 - Q1 Matched Taxable Gross Receipts by Industry. GROSS RECEIPTS AND COMPENSATING TAX RATE SCHEDULE Effective January 1 2022 through June 30 2022 Municipality or County Location Code Rate.

New Mexico Gross Receipts Quick Find is available. The largest increases came from the construction 18M and retail tradesectors 218M. Some of these changes impact the work of Signed Language Interpreters.

New Mexico State Tax Quick Facts. Gross Receipts Tax and Marketplace Sales. New Gross Receipts Tax rules take effect July 1.

When comparing MTGR Q2 of FY21 is most comparable to Q1 FY20 when Bernalillo County reported 78M higher in MTGR. May 19 2021 802 AM 1 min read. Several changes to the New Mexico Tax Code regarding Gross Receipts Tax GRT went into effect on July 1 2021.

The Legislature early this year approved a four-month gross receipts tax relief for the. Taxation and Revenue Department District offices are now open on an appointment-only basis. Among the 45 states and the District of Columbia which levy state-level.

Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. Table 1 also shows that only one industry reported a year over year YOY loss the finance and insurance industry. Fiscal Year RP-80 Reports.

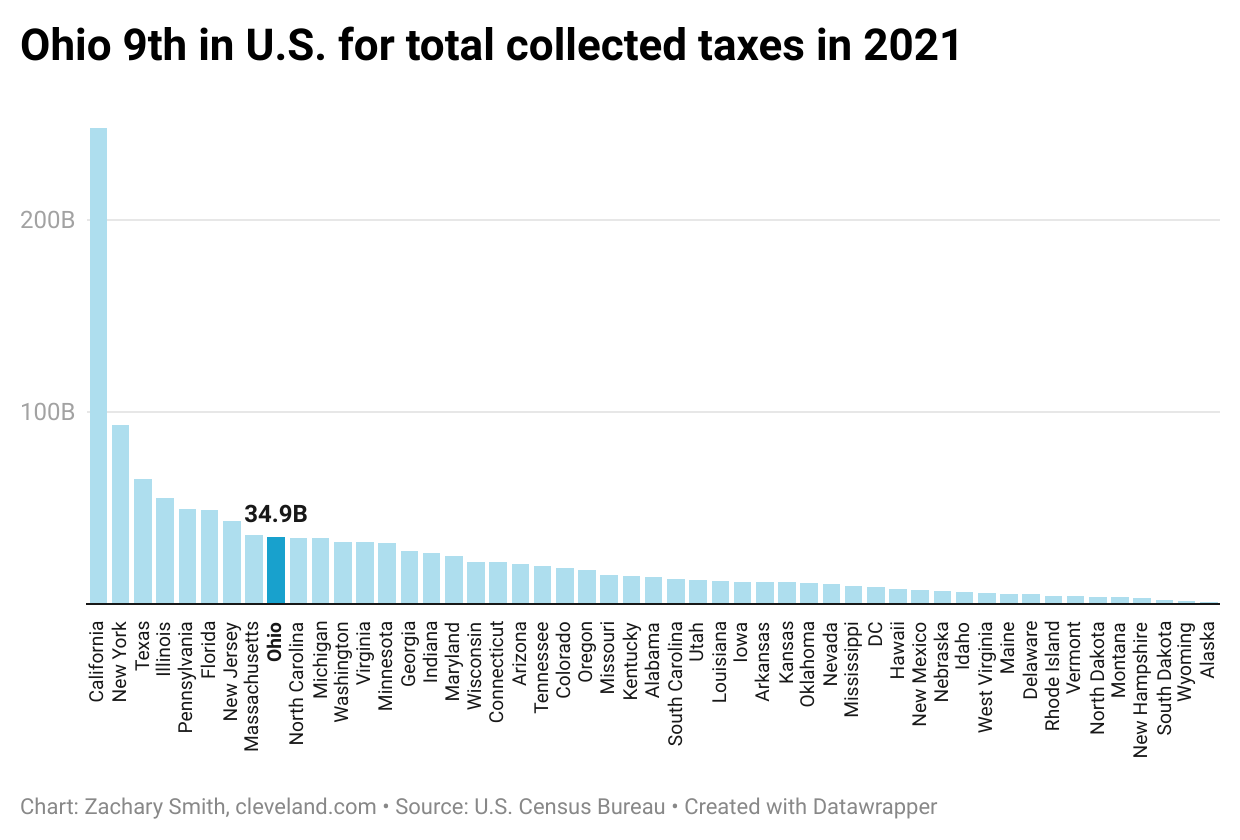

In fiscal year 2021 state retail sales taxes yielded 3753 billion in revenue and accounted for 2952 percent of state tax collections at a tax cost of 1131 per person. Click here for a larger sales tax map or here for a sales tax table. June 28 2021.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. New Mexico rates on average are higher than Arizona but lower than Colorad. Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the.

Texas Margin Tax allows for a choice of deducting compensation or the cost of goods sold. Five statesAlaska Delaware Montana New Hampshire and Oregonforgo a state-level sales tax. Shows 11 industries that reported a year over year YOY increase.

Taxable gross receipts MTGR remained relatively flat in Q2 FY21 as compared to Q1 FY21 as seen in Chart 1. None gross receipts tax of 5125 to 925 effectively acts as a sales tax Property tax. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000.

New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125. Most business will pay the rate in effect where goods and services are delivered. Table 1 on the next page shows a decrease of 1015M from.

More information is available here and on the Departments YouTube channel. Exemptions to the New Mexico sales tax will vary by state. Many of the documents have been updated to reflect this change.

The New Mexico sales tax rate is 513 as of 2022 with some cities and counties adding a local sales tax on top of the NM state sales tax. The amount reported in Q1 FY22 194B was the highest quarterly MTGR the state has seen. How to use the map.

BUREAU OF ECONOMIC ANALYSIS AND EDD CALCULATIONS. NEW MEXICO TAXATION AND REVENUE DEPT NEW MEXICO DEPARTMENT OF WORKFORCE SOLUTIONS US. More information on this standard is available in FYI-206.

Ryan Eustice Economist. The document has moved here. The Gross Receipts map below will operate directly from this web page but may also be launched from the Departments Web Map Portal portal link located below the map.

The largest increase came from the construction industry which posted a YOY increase of 19M or 994. Gross Receipts by Geographic Area and NAICS Code. BUREAU OF LABOR STATISTICS US.

4 rows The New Mexico State Tax Tables for 2021 displayed on this page are provided in support of. 078 average effective rate. FY22 - Q1 Matched Taxable Gross Receipts by Industry shows an increase of 737M from Q1 in FY21 to FY22 of the same period.

TaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms. Joel Salas Economist. The tax base and allowable expenditures vary depending on the design of the gross receipts tax.

Effective July 1 2021 the CRS number will be referred to as the New Mexico Business Tax Identification Number NMBTIN. Appointments can be made here. Gross receipts ta x GRT revenue collections increased by 408K or 129 from Q4 FY21 to Q1.

New Gross Receipts Tax rules take effect July 1 2021. From Q1 FY21 to Q2 FY21 MTGR declined by 357M or nearly 1. These changes have been confusing and the staff at New Mexico Taxation and.

Nevada allows a firm to deduct 50 percent of its Commerce Tax liability over. Nm gross receipts tax rates july 2021. Q1 FY22was 718M higher than the next closest quarter Q2 FY20.

Ohio and Oregon have flat rates of 026 percent and 057 percent respectively. New Mexicos total matched taxable gross receipts MTGR increased by 55 from Q4 FY21to Q 1 FY22 shown in Chart 1. Matched Taxable Gross Receipts MTGR.

NM Gross Receipts Tax Location Codes Rates New Mexico Association of REALTORS. Combined Fuel Tax Distribution. Municipality or County Location Code Rate.

Gross Receipts Tax Changes. Beginning July 1 most businesses will pay Gross Receipts Taxes based on the rate in effect where their goods or the product s of their services are delivered. Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable gross receipts in the previous calendar year.

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Income Tax Calculator Smartasset

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

Gross Receipts Location Code And Tax Rate Map Governments

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

50 Plus New Homes In North Charleston Brings Traffic Concerns To Congested Road North Charleston Traffic Dorchester

A Guide To New Mexico S Tax System New Mexico Voices For Children

2022 State Income Tax Rankings Tax Foundation

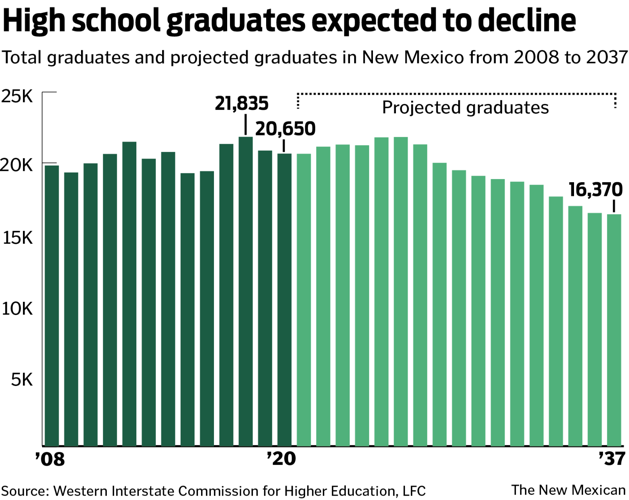

Report New Mexico S Stagnant Population Trends May Require Funding Rethink Legislature New Mexico Legislative Session Santafenewmexican Com

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

Nm Gross Receipts Tax Deduction For Food And Beverage

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New Mexico Sales Tax Rates By City County 2022

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation